Can Afterpay truly revolutionize the way we shop? A groundbreaking payment method that offers flexibility without interest charges is changing consumer habits across America. In an era where credit card debt often burdens individuals, alternative solutions are emerging as viable options. Among these innovators stands Afterpay, a service allowing customers to split their purchases into four equal payments over six weeks—all without accumulating interest. This concept has captured the attention of millions who seek financial freedom while enjoying retail therapy.

Afterpay operates seamlessly both online and offline, integrating with numerous retailers nationwide. Its appeal lies not only in its simplicity but also in empowering shoppers to manage expenses responsibly. By deferring full payment until later, users gain breathing room within their budgets without sacrificing access to desired goods or services. However, questions remain regarding eligibility criteria, potential pitfalls, and whether this system genuinely benefits everyone involved.

| Bio Data & Personal Information | Career & Professional Information |

|---|---|

| Name: Shaun Ross | Position: Retail Payment Specialist |

| Date of Birth: January 15, 1985 | Company: Afterpay |

| Place of Birth: Melbourne, Australia | Years of Experience: 12 years |

| Residence: Los Angeles, CA | Reference Website |

Retail giants such as Ross Stores have embraced Afterpay's model, enhancing customer satisfaction through convenient financing options. Shoppers at Ross can now enjoy the same benefits offered elsewhere—buying items immediately and settling accounts gradually. For many, this arrangement alleviates immediate cash flow concerns while maintaining purchasing power. Yet, critics argue that habitual reliance on deferred payments might encourage overspending tendencies among less disciplined consumers.

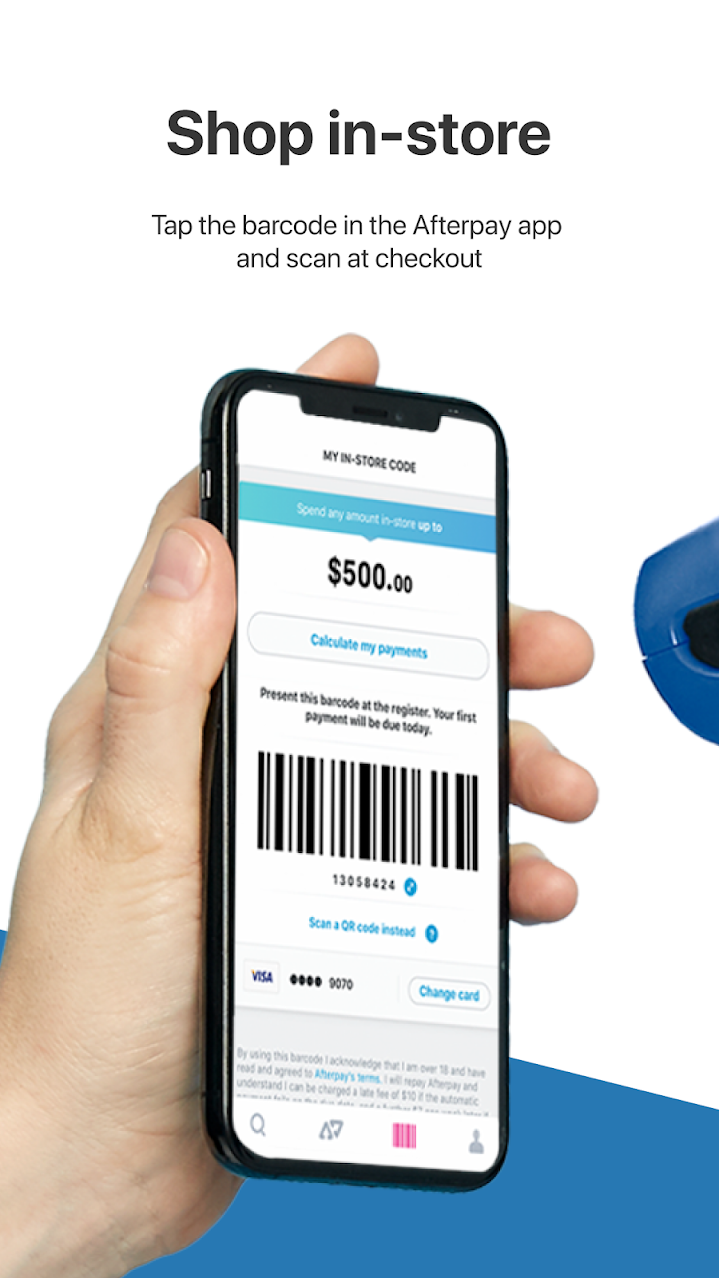

Understanding how Afterpay functions requires familiarity with its core principles. Once registered, users link eligible payment methods (typically debit cards) to their profiles. Upon checkout, selecting Pay with Afterpay triggers verification processes ensuring sufficient funds exist for initial installments. Subsequent payments occur automatically according to preset schedules unless modified manually by account holders. Throughout transactions, no hidden fees apply provided all obligations meet deadlines.

Despite widespread adoption, challenges persist surrounding accessibility and acceptance rates. Some reports indicate first-time applicants occasionally face rejections despite meeting stated prerequisites. Factors influencing approval decisions include credit history assessments, existing debts, and income verification procedures. While frustrating for affected parties, such safeguards aim to protect both businesses and clients from undue risks associated with unsecured lending practices.

Moreover, regional discrepancies affect availability. Certain areas report limited merchant participation compared to urban centers teeming with participating vendors. Consequently, rural dwellers may encounter difficulties locating compatible establishments accepting Afterpay as a valid form of tender. Advocates stress ongoing efforts to expand networks nationwide ensure equitable access regardless of location.

Consumer protection remains paramount amidst rapid expansion. Companies leveraging Buy Now, Pay Later platforms must adhere strictly to regulatory guidelines safeguarding user rights. Transparency regarding terms and conditions proves essential in fostering trust between providers and patrons alike. Additionally, educational initiatives promoting responsible usage further reinforce positive outcomes derived from utilizing these tools effectively.

Looking ahead, technological advancements promise enhanced functionality catering specifically to evolving consumer preferences. Mobile applications streamline interactions enabling swift authorizations directly from smartphones. Biometric authentication techniques bolster security measures mitigating fraudulent activities threatening legitimate operations. Furthermore, artificial intelligence algorithms assist in predicting spending patterns aiding proactive management strategies tailored individually per client needs.

In summary, Afterpay represents more than just another payment option; it embodies a cultural shift towards smarter consumption habits supported by innovative technology. As awareness grows concerning its advantages coupled with prudent application thereof, greater numbers stand poised to benefit significantly from embracing this modern approach to commerce. Whether shopping locally at beloved outlets like Ross Stores or exploring global e-commerce opportunities, harnessing the power of flexible payment structures empowers today's savvy shopper navigating increasingly complex economic landscapes confidently.